Hey guys!… first off, what an eventful week i’ve had… not trading but its just been one of those weeks where everything ya dont want to happen, happens but hey at least im still here to tell the tale. Anyway thats the reason for the delayed update, as promised i wanted to explain about this book i’ve been reading about change “Switch by Chip and Dan Heath” reason being its really quite interesting if your thinking about making changes on any level but it can be applied to trading too!

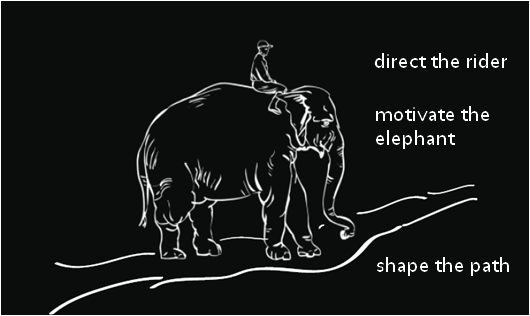

So whats the image above all about?! … its the concept they work on in the book, what your looking at is your own self control and how it fits with goals….. the rider is your Rational Decision making side, the Elephant your Emotional Decision making side and of course the Path is where your going be it through choice or not!

The idea is that we all make good rational decisions whatever they may be most of the time ‘assuming the riders role’ for example when your lookin at a market objectively with no trades open…… but it can change fast and go nasty when your emotional side kicks in and takes over, quite simply the rider gets tired and struggles to control this ‘assuming the elephants role’ ya know like that time a big bet come in and took you a few ticks into the red, consequently you lost your cool and went inplay! ha…. sounds familiar don’t it, then theirs the bit where if your hoping to constructing change is important. The Path of course! … if you dont know what the path looks like how do you expect to get their? Its quite important that the path is well mapped out and shaped preferable by your inner rider, having a path where by you say well i want to earn £300 a day is great but its a bit broad isn’t it? so a good question to ask yourself is what will that path look like and feel etc when im on it?… for example i’ll be using stakes that alow me to operate at £5 a tick consistently, ill have ample time to trade, i still won’t win all the time but will more often than not…. might seem daunting but if you want to get their you’ll need to be doing this, how else did you expect it? even top traders rarely take 100’s of ticks each day, i remember one high earner saying to me i recon i take around 30 ticks a day….. now obviously he’s on some serious stakage their but i think you get the point!

So its something i’ve started to think about and hopefully the more i manage to shape my path adjusting all sorts of things stopping the elephant getting a look in the easier it should be setting off into the sunset with the rider firmly in control….. with a suitcase of cash intact!

3 thoughts on “Elephants, Riders and Paths…..”

You’ll be joining neeeel’s new cult at this rate with all this mumbo jumbo, Caan. Sometimes commonsense is the simple answer.

LOL…. suppose it can be a bit deep at times, as warren buffet said – ‘keep it simple, stupid!’ still think its helpful thought to keep me on the right track, my innner elephants cost me a few quid over time!!

i liked the analogy ! 🙂 fits in really succinctley with what I’m learning in hypnotherapy at the mo,. about the struggle between yr rational side (which makes decisions and conclusions on the given information) and yr emotional side, which is exactly as Caan says — “losing your cool” when the trade backfires. Most importantly (as reiterated in Mind of a Trader podcasts) is the idea of knowing the path,.. or at least knowing your plaN. And walking it. (or in this case,… riding it),…. i personally have been able to analyze my trading through a journal and pick out the points where my rational side is undone by the [emotional] elephant, which is training me to keep the two in sync…. (albeit, slowlY!) — roN coobie