Natural Grocers by Vitamin Cottage is a healthy food retailer founded in Colorado and now with 165 stores across 21 states. The company trades at a reasonable multiple for a food retailer (15x 2024 EPS) and is reaching an inflection in growth that should cause re-rating of the shares to 20 – 25x P/E. In terms of intrinsic value, the company is slightly undervalued based on its DCF valuation.

The company is driven by the following mission: 1) nutrition education; 2) quality products; 3) everyday affordable pricing; 4) community engagement; and 5) taking care of crew members. The result of these principles is a compelling and differentiated format aligned with trends in healthy and organic food. For example, 100% of the produce is certified organic and all eggs and dairy are free range / pasture raised. The selection of healthy foods at NGVC is much better than conventional stores or even Whole Foods, and the shelves are not “polluted” with extensive unhealthy options. NGVC also lives the principle of education, and stores host educational cooking events, lectures and classes in dedicated space within each store. As an example of taking care of the crew, NGVC has industry-leading pay for in-store associates of $21 per hour on average.

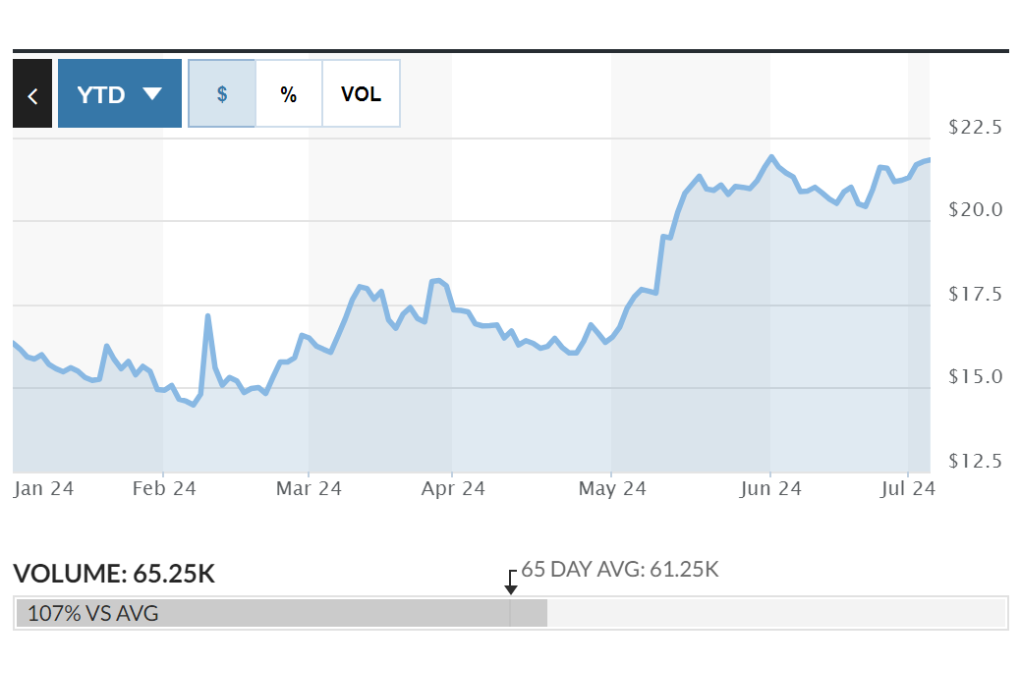

NGVC came public in 2012 at $20 per share. Investors saw potential to buy the next “Whole Foods” in its infancy due to NGVC’s high sales per square foot, high growth, and mission-driven culture. NGVC accelerated growth, and the store count went from 49 stores in 11 states at the end of 2011 to 140 stores in 21 states at the end of 2017, almost 3x storecount in 6 short years. However, NGVC botched this growth, and new stores were far less productive than legacy ones. Looking at the company’s fundamental analysis, EBITDA margins peaked in 2013 – 2015 at ~8%, and then fell to ~5.5% in all years since. Comparable store sales also dropped from ~10% at the time of the IPO to low-single-digit level. I believe management was inexperienced to grow so quickly. Management adjusted, and store growth slowed dramatically (2.6% CAGR for the past 6 years vs. 19% CAGR from 2011 –> 2017. The stock rocketed up from the IPO of $20 to an over $40 peak in 2014, before falling to <$5 per share in 2018 as the market choked on its previous enthusiasm and the poor execution.

Since 2018, NGVC management has focused on growing much more slowly, relocated stores in poorly chosen locations, and refining operations. Today, they are ready to re-accelerate growth.

The shares trade for the same 2012 IPO price, but with ~4x the revenue, and a much more experienced management team.

Thesis:

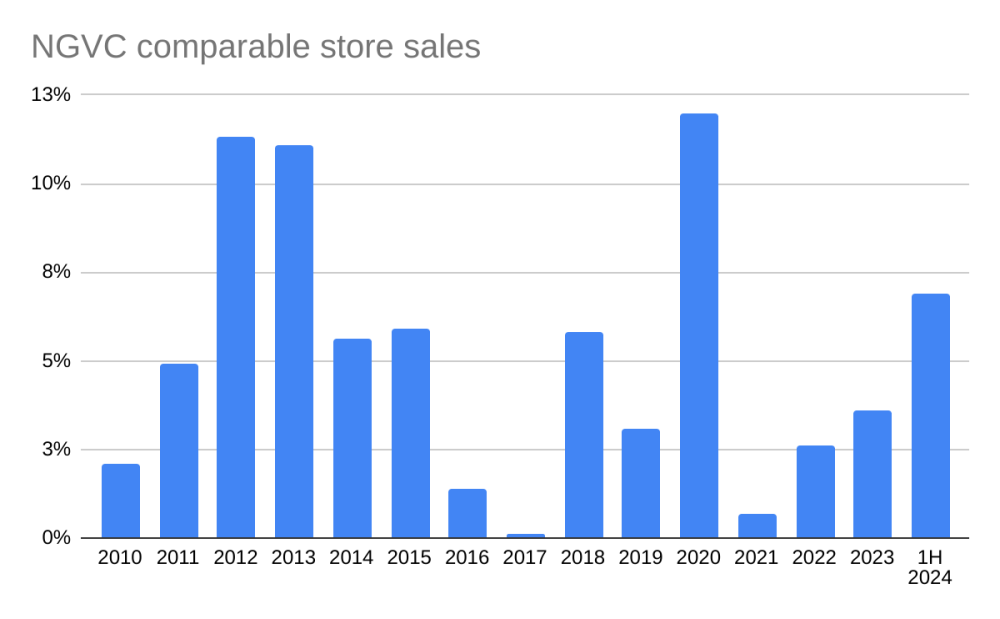

- Comparable store sales is a leading indicator for stock market performance in grocery retailing, and it’s inflecting upward for NGVC

- Store growth is accelerating and should be accretive given strong returns

- Margins are coming from trough levels and offer upside for EPS

- 1-year price target of $34 – $43 based on 20 – 25x 2025 EPS

Comparable store sales is a leading indicator for stock market performance in grocery retailing, and it’s inflecting upward for NGVC:

The best grocery retailers offer superior experience for customers and employees. They can only achieve this while delivering good ROE by driving higher sales through the box, therefore leveraging the physical infrastructure and “investing” in lower margins that in turn make prices more competitive and drive more sales through the box. The best example of this dynamic is Costco, which I believe is the best grocer in the world and a candidate for best retailer in the world (trades at 50x P/E and 17x P/B).

Because leveraging physical infrastructure is the most important thing in grocery, the most important quarterly metric is comparable store sales (which indicates if operational is increasing and by how much). NGVC just printed 7.5% in Q2, their highest quarterly comparable store sales increase since 2013 (excluding the one-year bump in 2020 related to COVID, benefiting all grocers at the expense of restaurants).

The quarterly momentum also suggests significant build, as the last four quarters of comps starting from Q3 2023 through the most recent Q2 2024 are 4.4%, 6.9%, 6.2%, and most recently 7.5%. Importantly, comparable-store sales tend to have more stickiness/momentum in food retail compared to other kinds of retail. For example, a fashion store can get a season right and have very high sales growth, and follow it with a flop the next period if they are off trend. People shop around in fashion stores. Grocery is different in that people show up with fairly set shopping lists. Customers in food retailers are therefore more sticky. As a food retailer becomes more/less competitive, sales will increase/decrease more slowly over time, which is why we see momentum in comparable store sales. Strong comparable-store sales indicate that a grocer has a competitive offering, and those strong sales are likely to have momentum into the next periods.

The reasons for the increase in comps are hard to parse, but given peers are comping in the low-single-digit level, it is an indication of increasing competitiveness for NGVC. Some likely reasons are:

1) Better use of personalized promotion through NGVC’s {N}power loyalty program (78% of sales are on this program)

2) Better merchandising / in-store execution

3) More aggressive pricing / promotion

4) Relocated stores are in more appropriate locations, permitting growth

In grocery, I’ve found that it matters more to see comps above peers, and parsing the reasons why is usually less important. It is also helpful if the online e-commerce website is indexed instantly by Google so that customers can know about the website.

Store growth is also accelerating:

The store count basically hasn’t grown for two years, and grew very modestly in the years before that. However, management has indicated interest in launching 6 – 8 stores per year going forward, suggesting ~4% growth. I think there could be further upside as management gains confidence in execution.

Growing the store base is a significant long-term opportunity for shareholders. Corporate-level ROE is ~20%, and I expect it to drift toward 25% next year.

Margins are coming from trough levels and offer upside for EPS:

Following the execution missteps of 2013 – 2017, EBITDA margin fell to ~5.5%. Through 1H 2024, EBITDA margins are up to 6.1%, which I believe is sustainable through the end of the year. However, I expect EBITDA could continue growing to 6.5% in 2025. Notably, EBITDA margin has been as high as 8% (for three years in a row in 2013 – 2015). 6 – 7% EBITDA margins are very reasonable, inline with strong grocers and modestly below what NGVC achieved when executing well. 6.5% EBITDA margin in 2025 vs. 6.1% in 2024 offers an additional $0.17 upside in 2025 EPS. However, for stables like milk, the company has very low or even negative margins to compete with other stores.

Between ~10% revenue growth and upside to margins, NGVC should do ~$1.70 in 2025 EPS.

1-year price target of $34 – $43 based on 20 – 25x 2025 EPS:

As investors catch on to the NGVC’s new growth profile and improving margins, I think the stock will further re-rate. There are very few (maybe no?) staples retailers capable of growing revenues in low-double digits for a long time, while increasing margins and generating lots of cash.

Consequently, I expect the stock to re-rate to 20 – 25x earnings, or $34 – $43 per share.

Risks:

This management team is very quirky, with the board of directors, executive management team, and shareholdings all dominated by the Isely family. The Isely family is extremely charitable, and often uses company capital for charitable donations. I’ve found investor relations to be extremely unhelpful and discouraging. Lastly, the Isely family also has six properties leased to NGVC.

Related to management, the approach to capital allocation is somewhat unpredictable: they often build cash for long periods and then issue large special dividends. I have no problem with this, and hope dividends continue to be the main use of excess cash, but it’s hard to know the underlying principles that would determine a change to the strategy.

Obviously management made mistakes in the past, and could make them again. While management isn’t candid about anything, the actions suggest that management learned their lesson, and will be more careful with growth going forward. They do know how to operate differentiated and successful grocery stores.