The Gambling Commission and its CEO Andrew Rhodes have been quite vocal recently…

Many things have been published and said about the gambling review – many of which are incorrect.

Last week Mr Rhodes took to social media with an affordability FAQ. Some of the statements made were ludicrous, as readers of this site will have experienced.

It leaves you wondering; what else have they got wrong? what else isn’t being shared?

So here’s a quick update to correct some of the misinformation that’s been shared. By no means is this an exhaustive list, in no particular order…

1 – Action Will Be Taken Against Operators Misusing Checks

In his FAQ article, Andrew said;

“checks must only be undertaken at the appropriate time and for regulatory purposes, and the information must not be used for any commercial purposes”

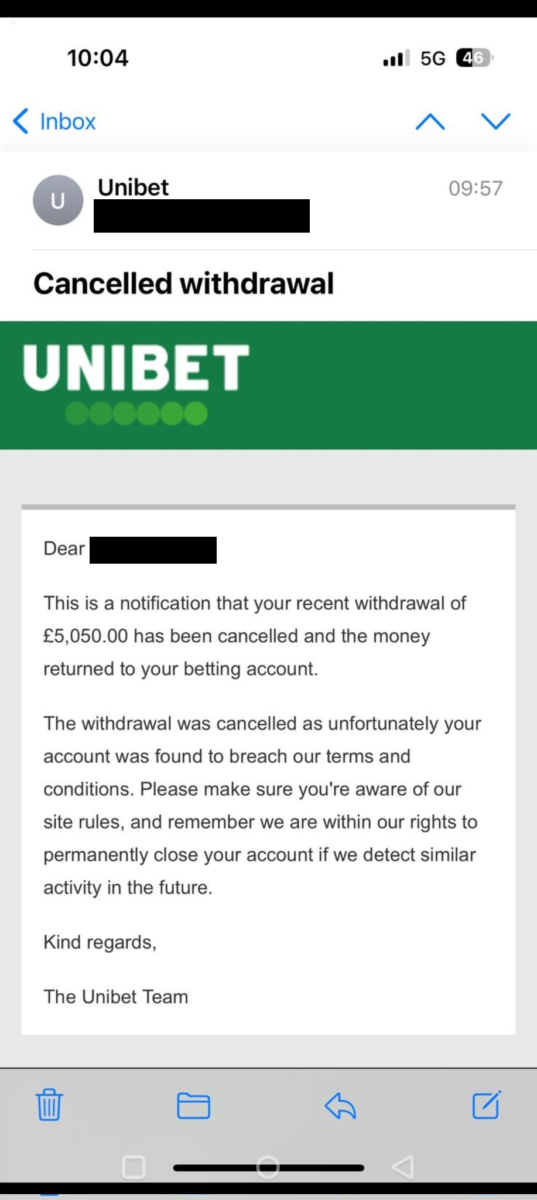

This is wholly incorrect. Over the last 2 years, many operators have requested consumer bank statements. Checks often come after a profit has been made and or whilst withdrawing. When consumer bank statements have been sent, the operators have used the ‘regulatory checks’ to enforce questionable T&Cs and refuse winnings. Clearly, using checks to enforce terms and conditions and enhance profits is not a regulatory or compliance purpose.

2 – The GC May Take Action Against Misquoted Statistics

In this open letter the CEO, Andrew Rhodes said;

“The Commission is very concerned at the significant increase in the misuse of statistics around gambling as different parties seek to make persuasive arguments for or against different proposals.”

“Where Official Statistics have been used inaccurately, the Commission will generally assume the misuse was accidental and ask the party to correct the record. If the party fails to do so, or declines, then we will consider referring the matter to the Office for Statistics Regulation (OSR). Something we have done recently. The Commission also reserves the right to publicly challenge the misuse of statistics by any party, if they fail to correct their misstatement.”

The statistics he may have been referring to are shared in a letter to Dame Caroline Dinenage.

At this time, it appears the commission hasn’t taken any action. Anti-gambling campaigners, activists and charities have since published statements about suicide, children and other emotive topics. This is nothing new, it has guided the gambling review for the last 2 years. In newspapers, TV channels, online and in-print, false statistics have been used, as mentioned in the letter linked above. In fact, it’s reached the point where they are now brazenly quoted as truth. Andrew Rhodes even posed for a photo in front of such misquoted misinformation himself.

To make matters worse, the Gambling Commission has financially rewarded repeat offenders with regulatory settlements. The inaccurate statements are still on their homepage, thus, it’s entirely reasonable to conclude that the enforcement of statistics only seems to apply to some parties.

For clarity, there are no official statistics relative to those on the side of this bus. Furthermore, it’s worth noting that statistics like this are not at all relative to online gambling or affordability checks.

3 – Affordability Checks Will Not Happen in Betting Shops

On the commission’s social media account in this video, Andrew Rhodes says;

“misinformation covers things like suggesting that large numbers of people will be affected by the checks, that personal credit scores can be afffected or they’ll be introduced in betting shops or on racecourses”

Plainly, this already happens.

There are numerous social media videos of consumer’s outrage when trying to collect winnings. It’s also been cited in multiple newspaper articles, like this one recently where William Hill held the customer’s winnings for 23 days while carrying out ‘regulatory checks’. This is also relevant to point #1 above.

4 – The Gambling Commission Have Not Mandated Checks

In his FAQ blog, although similar versions have been said in other places too;

“The government and the Gambling Commission have also been clear that we wouldn’t mandate operators to implement checks at levels such as those proposed in the consultation until we were sure that they can be delivered frictionlessly for the vast majority of customers who would be checked. We would be looking to trial this following the consultation, should we decide to proceed”

Now correct me if I’m wrong but the gambling commission has already fined operators for failing to complete social responsibility checks?

How can a company be fined for something they haven’t been told to do?

Furthermore, when confronting a bookmaker who is demanding your bank statement, they often respond that it’s needed for ‘regulatory checks and compliance’.

This one is particularly confusing. During the DCMS select committee hearing this came up too. When pressured the GC seems keen to shift the blame to either the operator, the ICO or the government. The operator blames the commission. IBAS blames the commission. The white-paper has put forward proposals based on advice fro the commission.

So how can it be that the commission has not done this?

If the Gambling Commission has not mandated checks then they need to (a) stop fining companies for failing to carry out checks and (b) ensure the companies stop telling consumers that they have to send their unredacted bank statements in order to ‘comply with the conditions of their license’.

5 – Checks Won’t Be Inconvenient Only Affecting the Highest Spenders

Andrew Rhodes said in his FAQ;

“Won’t these checks impact and cause inconvenience to a significant proportion of customers?

No, not at all and this is the key myth that we are hearing from various stakeholders. We have proposed a system of proportionate checks to target only the very highest spending customers where the impacts of any harm may be most severe.”

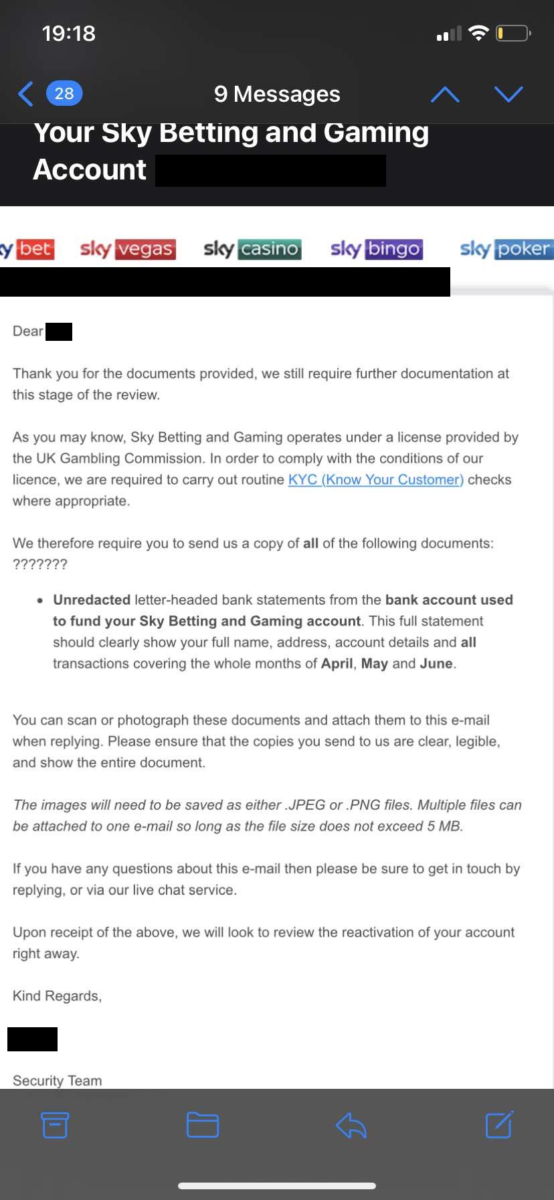

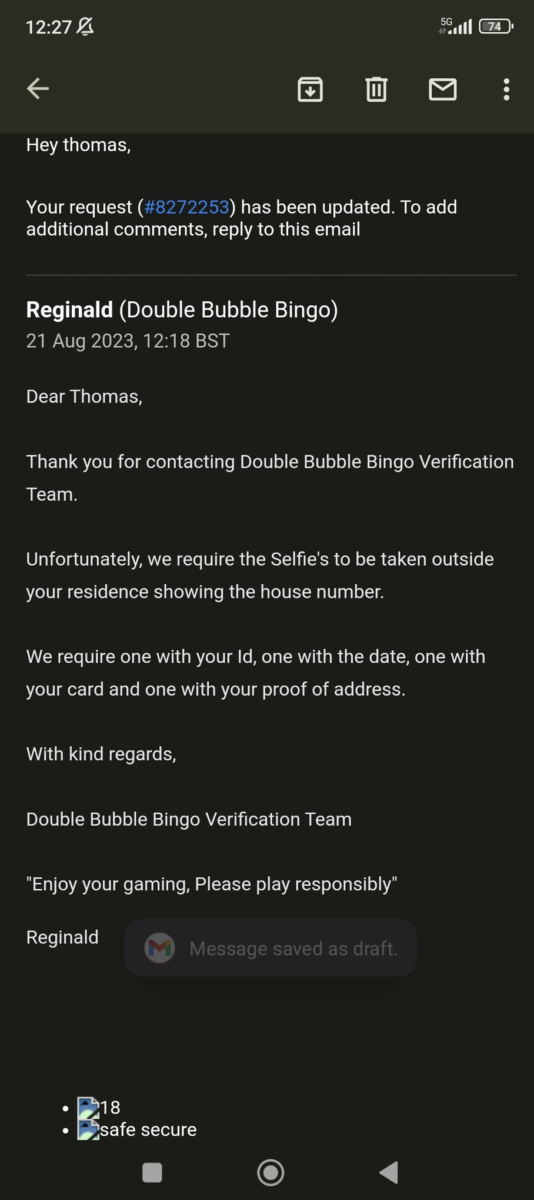

Again, this is incorrect with multiple cases to reinforce my point. Historically, checks and documents have been demanded for customers who have only deposited £10-50.

The checks are very inconvenient, often requesting bank statements, identity documents, financial history and more…

In most cases, it takes a couple of weeks to several months to complete the checks. Note, I’ve never heard of them happening on deposit, only on withdrawal (see point #1).

See the following request after a £10 deposit and win (high spender alert):

How Andrew can be so sure when it was recently highlighted that there has been no impact assessment is bewildering.

It leaves you wondering, what else have they got hopelessly wrong?

Some Facts Of My Own…

- The Gambling Commission doesn’t comment on specific cases (seemingly they don’t want to hear from consumers).

- When I wrote to them warning them about their licensee Football Index months before it collapsed, they didn’t take action.

- They have little interest in their licensee’s questionable terms and conditions.

- The efficacy of regulatory settlements distributed to those mentioned in point #2 is not effectively measured (£40M).

- Evidence for the public consultation on affordability checks in 2020/21 has still not been released to the public.

That last one makes you wonder why, doesn’t it?

Note: If anyone from the commission wants to reach out regarding these issues, or publish a response within this blog – I’m more than happy to communicate. You have all my details as I’ve tried to contact you many times before. Thanks.