Written by The Geek

Some of you will already know me by my online persona “The Geek”, the developer of Geeks Toy trading software, and the Profit Rush matched betting site which is a joint venture between my company and Caan’s. Those who know me well will also be aware that I have never written a blog post in my time 15 years in this industry, so I suggest you pay attention! This warning is not just about Football index, but any similar “Perceived Value” gambling/trading product in the marketplace that works in a similar way. These are my personal opinions, and should the powers that be at Football Index wish to have a discussion and “Enlighten me” on anything that is factually incorrect, I’m all ears as the intention of the article is not to mislead, but educate.

Short Version

WARNING: This is THE most deceptive/dangerous gambling product I have ever seen! If you want to lose a few quid a week in a fun fantasy football game, enjoy it. However, under no circumstances put any significant amount of money in there. If you have any significant money in there get it the f@*k out now, as the risk of losing it all is significantly greater than you perceive.

Long Version

History:

A few weeks ago, Caan was requested by his users whether he would use a relatively new gambling product that has been going for a few years and become very popular called Football Index. So Caan looked into their product and T&Cs and produced a damming review about why he wouldn’t touch it with a barge pole. In the weeks since he has received considerable abuse from some rather unhinged people with significant money in this product, which I was vaguely aware of.

One of the damming terms in the T&Cs gave Football Index the right to change the terms of an open bet on 30 days notice. The closest analogy I can compare this to is if at the start of the season you made a 4/1 ( 5.0) bet on Liverton to finish top 4 in the premier league this season, and 30 days before the end of the season when Liverton is in 3rd place, the bookies change the bet terms to “Top 2” or reduce your odds to evens. (2.0)

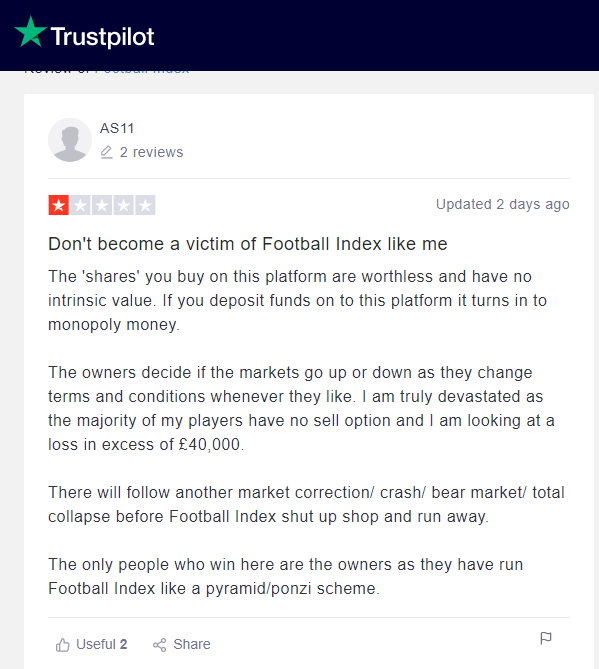

If bookmakers started doing this, punters would go into meltdown, yet somehow everyone signed up to it, and the unhinged disciples in their community were trolling Caan saying it would never happen. Last Friday, it did and as you can see from TrustPilot, some customers got significantly burned as their bets became worthless overnight.

Caan did a video about it at the weekend and again received abuse from some rather unhinged disciples. As we’re in lockdown at the moment and I have a little time on my hands, I popped on Twitter and started a little troll baiting, and over the course of the last few days have looked into the mechanics of the product.

Quite surprisingly, it’s not their outrageous, unfair T&Cs that has me seriously concerned!

Caan was correct, the T&Cs are unbelievable, and those alone would have me running for the hills. What does cause serious concern however is the semi-Ponzi nature in the way that the product works, and why I believe it’s doomed to fail eventually. I will try and explain the technical’s in the best way I can.

Every gambling product has a payout percentage, which is the average amount the house makes from a game/bet. This cannot be greater than 100% as otherwise there would be no business. So for example on a 90% payout percentage, on average for every pound wagered, the return is 90p.

Some well-known payout percentages for each game bet are:

- Roulette – 97.3%

- Betting Exchange Bet – 95-98%

- UK Fruit Machines – Legal Minimum 72%

- UK National Lottery – 50%

Of the gambling products above, only an idiot would play the lottery, right? But they do so because of the one in x million chance of a life-changing prize.

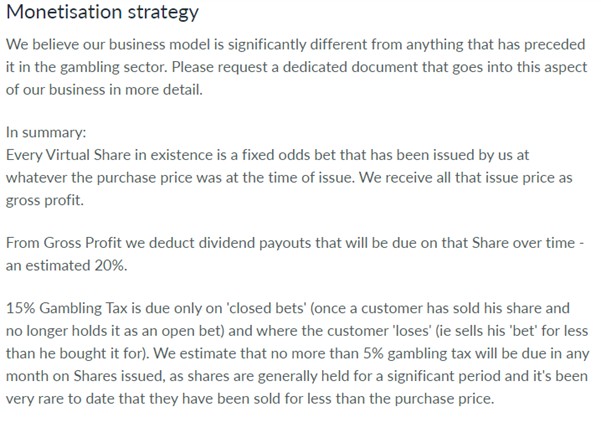

Now, whilst I don’t know the payout percentage for Football index, I am going to make a rough guess based upon 2 pieces of information they have placed in the public domain. The first is an investment pitch from them on Seedrs.

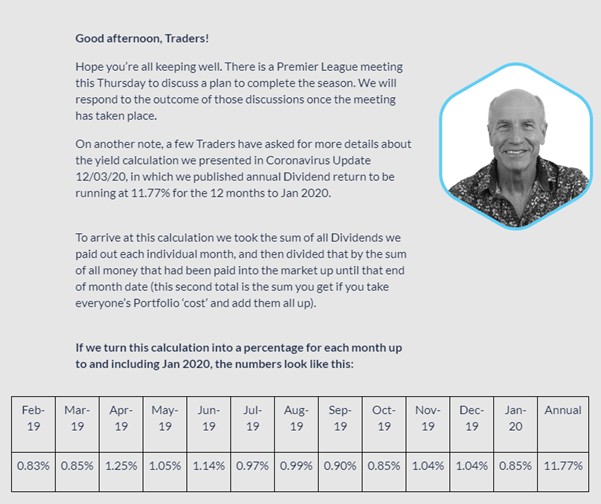

And the latter, a market update from March 2020 showing their dividend payouts.

A “bet” or share on football index is {supposed to be} a 3-year contract to receive a dividend on that share. Based on the latter amount of 11.77% 2020 payout, all years being equal, that is a payout percentage of 35.31%!

However, they are not expiring these bets after 3 years I’m advised, which could be related to the gaming duty avoidance they mention in their investment pitch, so the true number maybe a couple of % higher. But let’s be generous and say 40%.

Effectively that means if you buy a £1 “Share” in player “Joe Average” his true value is actually 40p.

This makes it the worst gambling product return ever, why the hell would I play It?

Artificial Value { AKA A Monopoly money trading market. }

The answer to why you would play the worst returning gambling product ever lies in the fact they have cleverly created an artificial trading market in the shares. The trading prices on this market fools it’s customer into thinking their balances are real by showing them a {sometimes significantly } overstated valuation based on the price they can achieve if the sold them, and like any market, the price is driven by supply which causes the price to drop, & demand which causes the price to rise. In this market, Football Index they are constantly adding new shares in at a price level of £1 and above for Joe Average whenever there is increasing demand.

But All I see on the internet is everyone winning on Football Index

This is caused by 3 separate factors, the first 2 are defacto in the gambling industry.

- Advertising Marketing Bias

With all gambling products, there is a bias / marketed perception of winning and every gambling company focuses on that in their advertising. An example of this is just about every Casino TV advert showing you a big win coming in on a fruit machine, or sports betting advert inferring you can win with your sporting knowledge. The reality is that because the odds are stacked against you, if you keep playing these games you will eventually lose it all. {Hence why there has been a more enforced social responsibility message in recent times.} This applies more so to an army off affiliate marketers { including customers with referring a friend code. } - Player Psychology

People, especially problem gamblers have a tendency to brag about how much they have won on a bet/game but will say very little about their losses. Considering that an estimated 95%+ of people lose to gambling products over a year, the polar opposite is true in how much they communicate about it. How often do you see your friends on social media bragging about winning a bet, and how often do they admit “to doing their bollocks”.

The third and most dangerous, however, and what has been the biggest driving factor in the spectacular growth of Football Index until 2020 is the artificial value in their “Monopoly Money” market. As mentioned earlier a market is based on supply and demand. If there is demand in the market, the price rises. People have seen the perceived success stories of others and bundled in causing the prices to rise. The more prices rise, the more people bundle in thinking this is the best thing since buying Tulips in 1637.

Football index has cleverly kept the true scale of demand hidden by selling considerable shares in “Joe Average” at a price of £1 or above but letting it rise enough to keep demand flowing in, and will do anything to stimulate the market.

Customers, who do the occasional football bet, who wouldn’t usually put money into a gambling product are putting thousands of pounds into this sure thing. { I have even seen 6 figure portfolio balances doing the rounds. } Everyone thinks they are winning, when in fact the complete opposite is true. “Joe average”, who is really worth 40p has been changing hands at ridiculous prices, and Football Index have been creaming it in selling millions of shares in him at these over inflated prices. They will do anything to push demand into the market.

But, like any bubble the model is flawed, and eventually, it will burst, especially this one as the true value of the share is actually the asset behind it, which in Joe Averages case is 40p. For the product to work, the operator needs to mint a certain amount of new shares every day and sell them at more than they are worth. {Operating margin & profit} As they become bigger, they have rising costs and need to sell more shares into the market. The market also increases in size, so even more demand is required to service the illusion that Joe Average is worth more than the 40p he is actually worth as a percentage of the market cash out their winnings. They also need to stimulate demand in the market so the advertising budget also increases significantly. This is unsustainable.

The best way to explain it, is using the ‘R’ number of a virus that everyone has become familiar with this year. COVID had an ‘R@ rate of 3 when left unchecked. This led to a doubling of cases every x days, and would have eventually infected a significant chunk of the population. However, what happens once a significant percentage of the population has been infected is herd immunity kicks in and the R rate decrease. Effectively, supply dwindles to negligible.

Why I believe the business model is doomed to ultimately fail, is that for the product to function and the illusion of value to be maintained, is it requires an exponential increase in supply and demand, which will eventually run out.

And when it does fail, there is going to be absolute carnage as people wake up one morning to the realisation that their monopoly money is worthless!

But Football Index is regulated by the Jersey Gambling commission?

They are indeed, but it is my belief that they and the UK GC don’t understand the mechanics of the extremely complex trading games. At the point the penny drops they will demand the companies involved to cease trading.

My funds are medium protected, right?

Wrong. Only your cash balance is medium protected. Whatever that is. { Unlike Belfair where it is fully protected. }

Your virtual monopoly money portfolio will be worth zero, zilch, nada, If / When Football Index go under.

COVID The beginning of the end?

Ironically, football shutting down for 2 months in 2020 exposed the weakness in the business model. { I say ironically, because I believe this is going to pan out as the biggest betting industry scandal ever, and it was COVID that stopped it becoming any bigger.}

Demand slowed because there was no football, and people wanted to put their “portfolio balances” to other uses. This for the first time created a net outflow from the market that football index couldn’t service so they pulled their “Instant Sell”. So as of that date, you can’t get out of the market unless some other fool is prepared to take the monopoly money shares off your hands.

This has caused an overall decline in the prices as in the past months supply is outstripping demand, revenues are a fraction of the pre-covid days and Football index are franticly doing anything and everything to stimulate the market. Reviews are appearing all over the internet of people losing thousands on the product, which is driving further negative sentiment. { Even though the reality is they lost when they bought into it }. They have considerable sponsorship deals to honour, running costs etc, and the only way they can raise additional cash would be to mint more shares into the market, thus causing further supply and pushing the price down further.

Every promised new project has failed to materialise, the man at the top has gone, and they’ve pulled the rug on one of the dividends with no announced replacement. Will they survive 2021, maybe but I believe the can is just being kicked down the road for an even bigger scandal at some future date.

At whatever time they do go bang, the governments need to also shut down these other “Perceived Value” gambling products, as the same pyramid bubble will be inherent in their models too and they are the most dangerous gambling products I have ever seen in my life!

Watch the Original Football Index: 5 Risks

45 thoughts on “Is Football Index a Ponzi Scheme? The Emperor Certainly Looks Naked.”

Absolutely fantastic written piece that. I personally got my money out long before Caan’s video appeared on YouTube as something didn’t feel right to me. As you say there are others that will stick with this until it’s too late, funnily enough, a bit like the COVID vaccine, once that jabs gone in, there’s no turning back!

People have to make their own mind up at the end of the day 🙂

Goal Profits have been running a test of this over the last few months. They’re so far pretty unexcited and neutral about it but haven’t expressed any similar concerns. The very nature of the product put me off as I suspect it will for a lot of punters but anyway but thanks for the heads up.

Well done, Paul and Caan. As Phil Bull always said, legislators simply don’t understand gambling; but now that they show signs of targeting betting, led by often misleading and misinformed campaigns in the popular press, it’s particularly important that the exploitative (if not fraudulent) aspects of the betting industry be exposed. I think the Owner’s Group syndicate business offers a model of clarity in explaining what an ‘investment’ means, in detailing how the business works and where the money invested goes, and in leaving no doubt that the main return to the investor is the fun to be gained from being involved in ownership; such standards of disclosure and openness should be required in the selling/advertising of all betting products as well.

I am utterly shocked I have been robbed,ripped off, I will not be dealing with them again, they never made it clear on there website that there was any hidden fees or any football trade will not give positive payouts, it did not matter how long I had a trade on for and what I traded when football index was new out, I never seen any progress of making profit,it stayed in the red, and the money was gradually disappearing.. And even trading out it went fast..it is utterly shocking a disgrace,robbery, no one is benefiting at all…there is another new website doing a similar thing to football index, I am not in a hurry to join it..thank you for sharing this important info x

What’s the name of the new website doing a similar thing to Football Index…?

http://ItWillEndInTears.com

I actually posted some serious questions about the ‘transparency’ and just how ‘legit’ this product was in their Facebook group.

Oh my god, I was hunted out of the group by admins wielding pitch forks and flaming torches!

I hadn’t slagged the product off at all but these guys wanted my blood and within an hour I was banned and my post removed.

A great piece here highlighting a lot of my points I was trying to make people aware of!

Spot on Paul. This is a Ponzi scheme make no mistake. The last time I saw anything and as many people so deluded was the fabled/infamous OneCoin. Great article you really should write some more.

The Jersey and UK GC don’t understand Football Index which is why it’s not been shut down but the bald nonce and his caped crusader who have never used it know how it works fully… Football index has major flaws as it transitions and its users know that get back to Betfair and stop worrying about FI if it’s going to fail why are you so bothered?

So you can’t see anything wrong with the article then? I mean, factually speaking.

How’s this looking for you now mate?

Making reasonable estimates from statements the company themselves have declared:

1. Last week in an e-mail to users they stated they paid £19m in dividends in 2020

2. Several times over last 6 months both current and former CEO confirmed they have committed to a ~£15m advertising budget

3. Company employs ~60 staff across 2 offices

***

1. Dividends were £19m in 2020 despite them only being doubled in Q4 (25% of year)

Reasonable estimation of 2021 Dividend Cost = £30m

2. Company themselves boasted of >£15m advertising commitment for this season into Euros Reasonable estimation of 2021 Marketing Cost = £15m

3. ~60 Staff + legal, compliance, tech, tax etc

Reasonable estimation of 2021 Operating Cost = £6m (£500k/month)

The company has ~£50m of outgoing in 2021

Debate and argue the exacts all people want but this is rational estimation from what they have told us, even if you argue it’s more like £40m the reality is the same.

First removal of Instant Sell and now a knee jerk removal of IPD’s (without a replacement ready) it is pretty plain to see the direction of travel it is shocking how few people see it.

I Second Peter’s comment on the “pitch fort mentality” of some of Football Index’s community. After seeing Caan (and I assume others were to) been hurdled with abuse for making a valid point, I simply shared my own feeling’s about F.I. Never once subjecting anyone personally to any abuse or attacking anyone’s views. The same can’t be said for some of those who responded.

In the end I was heckled as a “Fanatic Cran Berry fan!”

Standard go-too answers; you have an agenda, its all incorrect (fails to mention how), you haven’t used it so can’t comment etc.

Though I did find that particular Heckle pretty amusing no harm done

Back in August, I invested the grand total of a tenner into the FI website. I’d seen a Championship player about to move to a PL club and thought I’d experiment to see how this nonsense worked.

I bought “shares” in the player and since then he has 1. Moved to a PL club 2. Nailed down a first team place and 3. Scored goals and earned a few rave reviews.

Yet throughout his value has decreased and has now gone down by 20% since the date of purchase. I could launch into a thesis on why this has happened, but I will stick to a shorter summary, which is “what a load of b*ll*cks”.

Great Piece.

Over 5 days in early April, i received e-mails from chris written by a chap called Josh Allen, finally revealing after 4 days the best thing since sliced bread….Football Index.

Stank of desperation. Needing demand for their supply.

Read bad reviews back then on Trust Pilot.

Talk of folk making thousands in the e-mails.

Total bollo*s.

It immediatly stank of a ponzi scheme to me & i avoided it like the plague.

So, chris/josh were big pushers of this product back in april. Also how the hell are they allowed TV ad’s ?. The jersey lot and the gambling com’ need to get wise to these products.

Personally I bought only twice , both times when they offered cash incentives for doing so , assume they were expecting me to buy more shares with the cash they gave me , nope cashed the shares and withdrew the lot , that probably didn’t help their operating costs either , but it obviously did help with short term demand , I did consider a proper investment but when I saw the fees and t&cs I knew I was on a hiding to nothing , that’s the gambling world for you though someone can sell you something that’s worth less than the cost and guess what that is perfectly legal , but then same is true for anything , I saw a speaker product on eBay the other day , one which I owned I noticed some of the integral parts were not included like the controller unit ( in this case the most important part ) I paid £100 for the product 5 yrs ago brand new fully functional all parts included, this idiot wanted the same £100 for his product with half of it missing and no way of it ever working as intended , when I enquired he said it’s sold as seen , what any buyer does with it would be up to them , it’s a cruel world alright

Can i ask why now? Football index has been going for over 5 years and been growing massively over the last 2 years. This isnt the first time you have become aware of it so why choose now to attack it?

Could it be you saw an opportunity to kick a rival while its week? Because we all know you wouldnt be obsessing over it this much out of the goodness of your heart.

These attacks from you and caan are purely in your own self interest and you picked you timing well but it doesn’t make either of you right.

Some get angry at you and that is unjust but you gotta do what you gotta do to survive and o believe that is what drives you and Caan, it raises your profiles because any exposure is good for you. Anything for likes, views and subscriptions but at the same time i hope people can think for themselves and see through your bullshit.

Personally, I had only heard the name in passing until about a month ago when I took a look for the first time (the first video).

I created the video as several of my following had asked me to take a look and I thought it may be interesting as a new platform as you mention.

I haven’t attacked anybody. I was asked to review, I did, it didn’t sit right, since that time I’ve faced an onslaught of abuse as you may see from other comments on a daily basis across multiple platforms. I’ve also had lots of fake reviews and reports to YouTube etc.

The information shared is taken from the public domain and terms and conditions where FI have commented so I don’t see how it can be incorrect?

I too hope people can see it all for what it is and make a fair judgement on their own. I hope you manage to get some of your money back!

Mate i make money on FI on a daily basis and have done for over 2 years. I absolutely love it and know the platform inside out. Its a horrible period right now and i dont believe for a second you only first heard of it when you did but if thats what you claim fair enough.

I dont believe you care for those peoples money I believe you are vultures that want that money in your domain where you can pick away at it.

Another thing about the timing of all this thats strange is that im hearing rumours betfair are considering creating their own version of FI which is odd considering the attacks arent just aimed at FI but at all platforms like it.

The community has treated you unfairly i think but you have upset a lot of them by not really understanding what you are talking about. You are an intelligent guy but you also seem quite stubborn with a need to feel you are right.

Good luck to you but please stick to what you know and understand

Hi Thomas,

You may believe what you like, but I have only heard more about it since the summer when have contacted me about it as order books were released, making more like an exchange.

I do care for people’s money, again your choice to believe. I feel sorry for the young lads that say they have emptied savings etc.

Timing and Betfair replicating? Do you have a link? Right now is the first I’ve heard of this. Also full disclosure – I have a Betfair affiliate account that makes about £60 a month. It’s a ridiculous accusation to say they are incentivising me to point out what is some factual information in the public domain for all to digest. Also, note in the article FI is invited to correct us on anything within – no response.

The community is still doing so, and on a level you could not possibly fathom.

Again, you say I don’t understand what I am talking about but you don’t say what is wrong and why it is incorrect. This seems to be the standard response from the FI community.

I will do as I please and have no intentions of yielding to bullies, although I’m quite happy to be corrected and concede anything I have said that is wrong, but you will need to prove it.

I understand this FI model clearly, based on the information in the public they have provided.

I haven’t commented on FI for 4 days now and am still receiving a large amount of abuse; why wouldn’t I talk to the reporters contacting me?

I’d suggest directing your anger and frustration and anger at those responsible for your losses – FI.

Thomas

It only came onto my radar circa 7th January when I had a conversation with Caan about his book being 1 starred 40 times in a day in coordinated attack from the Church of Indexology because he wrote a review of the product and said he wouldn’t touch it with a shit stick, and that there had been a period of sustained abuse from this cult for a period of weeks.

On the 8th January one of the risks he highlighted in the video came to fruition, and a lot of people were seriously burned by this. Yet out came the usual cult members attacking him again trying to silence him. { In fact, here you are doing a similar thing, with your “but please stick to what you know and understand” comment. } I’ve been told that the mentality of this crowd is something akin to one-coin.

So I went to bait a few of the trolls on twitter and started looking into this company, and the alarm bells were going off everywhere. Whilst I don’t believe they deliberately set up a Ponzi Scheme, the mechanics of the game are pyramid in that it needs exponential growth to sustain it. This makes it doomed to fail because eventually it would swallow up all the money in the world. Hence why I wrote the article, and immediately warned my user base off it.

This isn’t just in relation to football Index, but anything masquerading as the same thing.

Thousands of people have been deceived into thinking of this product as an “Investment” and have been sticking silly amounts of money in there, and have been seriously burned, without even realising it. Why they were even allowed to wager this kind of money on a poor value gambling product will be questions asked by many people I’m sure.

But the Church of Indexology refuses to accept it, think it’s a campaign to bring down a competitor, and no matter how much you try to explain it to them, and now making up exaggerated and inaccurate smear campaigns against myself, Caan, Mark and the Journalist who published the article.

I am aware that senior management at Football Index are aware fully of the article, and yet they have not yet come out do defend their model providing their users and reporters with evasive answers. Neither have they advised me that any of the article is incorrect, nor have the lawyers been in touch.

Commercially we have seen no impact from football index. It is also important to understand that Geeks Toy is a Global product used in over 100 countries, whereas football index is just UK based I believe.

The reason it’s in terminal decline the past months has little to do with the tinkering that they are doing round the edges of it, but because the model is failing as the prices of players adjust to their true value. The model is already non-profitable / sustainable looking in at it, and won’t survive unless there is a significant change in the game mechanics / monetisation.

And I don’t care what your beliefs are, I really do have a serious concern for all these people deceived into doing their absolute nuts on this platform.

This aged terribly.

Why does he call himself a geek, when he is so dumb. He has no understanding of the product and the reason why it has failed. I bet he’s never even used the product.

So why has it failed, please do enlighten me?

Rather than attack him, why don’t you set everyone straight?

Whoops!

Um … has anyone thought to share this issue / article with the UK Gambling Commission?

If so, what it their take on it?

You would need to ask them that.

Caan Berry is an ugly bald headed nonce.

caan berry is bald and wears crap superdry clothes. ha ha ha ha

loserrrrrrrrr

I wouldn’t call it a ponzi scheme, which is fraudulent, but certainly would say it’s a pyramid scheme, as earlier investors have profited from the sites growth, and whilst I agree I find it hugely alarming (certainly unethical and perhaps illegal) that FI can change the bet at the drop of the hat, the real reason for the down spiral is as you say the coronavirus pandemic that caused an influx of panic cashing out which lead to FI drastically changing the goalposts… If FI had stood firm, they would have lost investment short term, but would be back buoyed by new investment from those seeing opportunity in undervalued stock.. Because they stopped people from withdrawing funds which caused a complete dismay of trust, the ship unfortunately now is sinking because of it.

Certainly not set out to be a scheme to take money from people, one set up with good intentions, unfortunately (for those who invested more recently) implemented very badly indeed. You can still make money from investing in FI, but it is no longer for any tom, dick, caan or harry, and instead for those who see opportunity in other peoples downfall!

This is the problem, people call it “Investing”, it’s not and they are fooled into sticking silly balances into a market where they are ultimately destined to lose it all unless they can get out before the model fails.

All I can say, based on this post about Football Index, is that I’m glad I knew nothing about it until I found Caan’s video and watched it through when he highlighted his concerns.

Now I can see that there’s a lot of smoke and mirrors involved, which is how great magicians like David Copperfield fool/fox us all, I’m glad that the warnings have been reported.

My barge pole is now three times as long as I’d normally need it to be. As the old adage goes, “If something sounds too good to be true, it probably is too good to be true.”

Caveat Emptor applies to everything. But especially to this ‘investment’.

Do you reckon FI will survive? I took a big hit and took out what I could as I lost faith, platform crashesd so many times…such a shame though because it was great before order book came along.

I strongly believe the business model can’t survive in it’s current form. The traded volumes are in constant decline as things adjust to their true price, and liquidity is drying up. To re-engineer it to be both profitable and not depend on exponential growth to sustain it will be a massive challenge in itself. { Would love to be part of that development team. 😀 }

Throw in the combination of the current negative user sentiment, the complete lack of public communication from the company other than to try and firefight negative Trust Pilot reviews with evasive answers, and the fact that they’ve lost the “Everyone getting their mates to pile their savings into an unsustainable bubble PR effect” makes it even more of a challenge.

The negative impact on the sports trading industry from this is going haunt us for a long time, especially when the GC dig deeper into the sums people were allowed to deposit into this thing and the massively deceptive portfolio balances that are still being shown today. { Buy / Mid / Avg Buy }, Instead of Sell / True Cashout value after commission.

So basically I made the the right choice of cashing out a few days ago?

The rating is 2

4 on playstore and 3.6 on trustpilot..surely that will scare a lot of people now?

You hand in your ticket

And you go watch the Geek

Who immediately walks up to you

When he hears you speak

And says, “How does it feel

To be such a freak?”

And you say, “Impossible”

As he hands you a bone

Because something is happening here

But you don’t know what it is

Do you, Mister Jones?

Nice article… Knew something was dodgy when Sancho hit 16 quid.. Glad i got out last year, albeit at a loss.

For all the abuse you’re getting, you’re a top man in my eyes. Keep up the good work on all fronts

Well this was almost prophetic. A market crash and people losing tens of thousands of pounds.

Company gone into administration. Licenses suspended. According to UK Gambling Commission, “The suspension follows an ongoing section 116 review into the operator, as we had concerns activities may have been carried on in purported reliance on the licence, but not in accordance with a condition of the licence, and that Football Index may not be suitable to carry on with licensed activities.” And yes, customer funds are not protected. Oh Dear!

Just stumbled across this article now after reading about the demise of FI. Will certainly look out for more of your work given how prophetic this was!

I take no enjoyment from the misery of others (except the idiots who abused you when this was first published, I hope they are sobbing into their humble pie) but do think punters should have done more research before ploughing potentially life-changing sums of money into this platform. It was pretty obvious is was gambling rather than investing given that it was regulated by the GC not the FCA or similar.

This seems to me to be a hybrid of gambling, a ponzi/pyramid scheme, fantasy football, the stock market and MLM. I explored the idea of investing a couple of years ago, and the army of rocket-tweeting disciples had me excited, but in the end there were enough clues there to suggest this wasn’t all it was cracked up to be.

Great article, hope you do a follow up, you deserve it!

Great article.

I signed up with FI in 2016, the amount I put in was tiny (£300 over 4 years) compared to most.

This is my introduction to what I thought was trading, I liked the idea of it being all about football.

At first things were going well, and over time I would top-up bit by bit. What really built my trust was the advertising at football games and shirt sponsors. Then they got Nasdaq involved and I thought this was going to become like a proper trading platform. It feels as though since Nasdaq came in they tried to change too much, too soon and in addition to Coronavirus shutting down football, things seem to have gone downhill very fast.

I have only been following Caan and The Geek for about a month or so, since trying out Betfair Exchange, I wish I had found you guys earlier tbh.