How does cross-matching work on Betfair? What does cross-matching even mean? Quite a few of you asked after a post last week about the weight of money and the over-round.

Rather naively I assumed it was one of those things that all new traders would have looked up.

Apparently not.

In this post I’ll explain the following:

1. What is Betfair cross matching?

2. How cross matching works…

3. Cross matching calculations

4. Why was cross matching introduced?

5. How cross-matching affects traders

6. A few common questions about cross-matching

If you’re serious about trading on Betfair, it’s crucial that you read and understand this article in full. At first, it may seem complex and confusing, but it’s really not. Just follow along with the examples and your betting exchange knowledge will take a leap in the right direction.

What is Betfair Cross-Matching?

When betting exchanges were first introduced, it was just a case of getting a bet matched against another user.

There wasn’t so much ‘smart stuff’ going on. It was just backing and laying…

The market was pretty ‘dumb’ by all accounts. Probably why you hear tales of instant riches and £100,000 a month (those ahead of the curve).

However, there were some pretty big changes when cross-matching came in from Betfair. In all honesty, though, it probably existed way before Betfair implemented it, just via one of the big players, and at a wider margin. I guess that’s every automation geek’s worst nightmare; Betfair replacing you, what’s to stop them?

So what is Betfair’s cross-matching algorithm?

As the name suggests: in betting, cross-matching is the process of bets being matched across other outcomes in the same betting market. Inversely proportional bets are matched against each other to create additional liquidity within a betting market.

The easiest example is to look at an event with only two winning outcomes, like tennis. A back bet on player A is equal to a lay bet on player B. Meaning if you were to open a trade on player A with a back bet, you could close the trade on player B with a back bet also. In fact, that’s exactly what the ‘trade shark hedge’ function does within the geeks toy software.

In the past, if you placed a back or lay bet way off the available price and there was no money in the market, it would sit there until it was matched. Now, the cross-matching algorithm will see it matched sooner. More on how cross-matching works and cross betting in a moment.

Using a special algorithm, the market sees the unmatched bets suddenly matched, all in the blink of an eye.

Before you read on; don’t let all this send you into a panic.

It’s important to have an idea of how cross-matching works and what cross-matching is, but it’s not the end of the world. Understanding the principles and where or why Betfair’s cross-matching algorithm kicks in is more important than the actual calculations. It helps formulate good horse trading strategies and decisions in particular. New traders often get in a muddle when it comes to understanding cross-matching, it’s not the easiest thing to see in your mind’s eye without a pen and paper.

I’ll do my best to keep things super simple as I explain…

How Does Cross-Matching Work on Betfair?

Here we go…

If you haven’t seen it already, it may be best to read about how betting odds work here first. Betting markets operate to 100% over-round on Betfair because of the cross-matching algorithm.

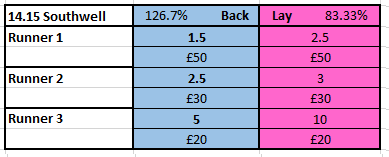

Let’s start with an example of a ‘typical’ illiquid market, and how it’ll often look way before an event starts.

As you’d expect, the book is sufficiently ‘slack’ with large gaps in pricing. Over-round percentages are shown at the top of each column. Nothing unusual about that.

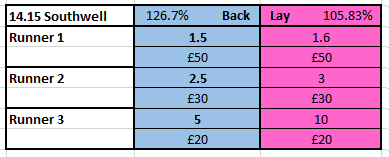

But for argument’s sake; if there was no other money in the entire market, other than displayed. What would happen if a back bet were to be dropped into the market at a significantly shorter price? (see how the £50 previously at 2.5 is now at 1.6).

First of all; this could never happen now unless Betfair’s cross-matching algorithm was off.

Why?

Because the lay side of the book is now larger than 100%, this would trigger Betfair’s cross-matching algorithm. In fact, it would be triggered far sooner than if the bet were to be dropped as low as 1.6.

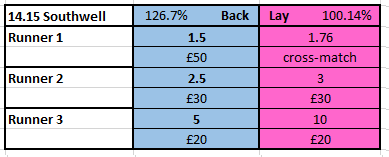

The first price at which the cross-matching would be triggered in the example would be 1.76. This is where the lay side of the book reaches more than 100%.

When the book reaches 100% it means that; it is now possible for Betfair’s cross-matching algorithm to trigger and spread the invaluable bet across the other ‘available’ bets in the market. This is calculated in line with what money is at those prices within the market at any time. Also, bearing in mind that the prices are different, the stakes will be different at different prices.

Basically, what I’m saying is; at 100% the 1.76 bets can be made equal to money waiting to be matched at 3.0 on runner 2 and 10.0 on runner 3. So instead of needing lay money to be available at 1.76 on the favourite, it already is, at 3.0 and 10.0 respectively.

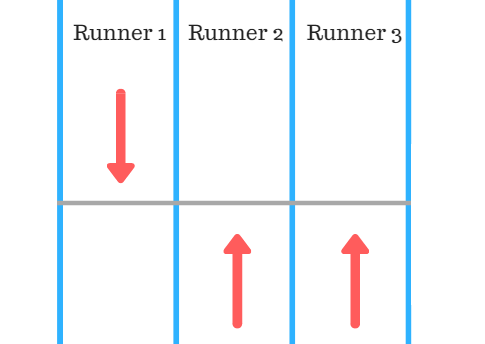

The simplest visual I could come up with…

More in a moment but the thing to remember is, when an invaluable bet enters and the cross-matching is triggered, it effectively causes pressure in the market like this:

The more aggressive the betting is within 100%, the more money that will be simultaneously matched on the other runners. Cross-matching is triggered by both back or lay bets.

The Cross Matching Calculation:

If you’re interested, in the cross-matching calculation and other information (mainly for automation and vendors) there’s more via the developer program here.

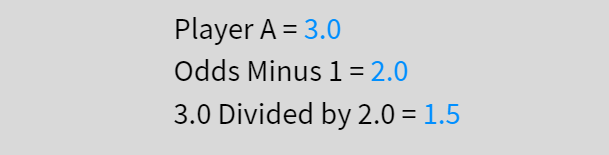

Simple explanation: To calculate the reflecting odds between two selections it looks like this…

Equivalent Back odd = Back odd/(Back odd – 1)

So for example. If it were a tennis match, player A may be trading at 3.0. This means player B has to trade a 1.5 because:

Beyond two selections it gets more complicated. But as previously stated, it doesn’t matter so much to manual pre-race traders, as long as you understand the possible effects the cross-matching can have, and when it’s likely to trigger. This is more about understanding the flow of the market. Cross-matching ensures a kind of balance.

Depending on which sport you prefer to trade will depend on how important the cross-matching calculation will be to your trading. Events where there are limited outcomes, such as tennis or the unders and overs markets in football make spotting the cross-matching far easier. Within racing, there is far more attention on the few selections heading the market when it comes to identifying cross-matching.

Why Was Cross Matching Introduced?

To increase liquidity and user experience I believe was the corporate line from Betfair in 2008.

Many have expressed different views. As I said earlier though, I fully suspect there were or at least would have been individuals running automated programs on the exchange like or similar to this previously. After all, if you look at the example above. All back bets entering the market between 1.6 and 1.76 would effectively be giving away free money to someone running such a program. Now that person is Betfair, and so are the small profits attributed to each cross-betting match.

Bearing in mind how often that would happen, and how much money could be made, it’d be silly for them not to. Longer-term followers and pre-race traders will have seen ‘the bomber’ as he’s affectionately referred to (a massive mug punter that takes huge chunks out of the price on the exchange). This kind of behaviour routinely triggers cross-matching, giving away a lot of value in the process.

Another reason that circulated at the time was; the additional revenue cross-matching provides will fund development for the exchange. I’m sure they’ve spent a lot on the upkeep although from the outside it doesn’t seem to be the case.

When cross-matching came in, many complained their competitive edge disappeared or was drastically reduced. I can’t comment though, cross-matching was active before I made any proper money!

With that in mind…

How Does Cross Matching Affect Traders?

With this formula, we can see the exact difference between matching an order and being ‘cross-matched’.

However, it is important to note that Betfair respects the FIFO principle within the formula – first in, first out. I’ve seen many arguments to suggest that this simply isn’t being followed. For example, many people have noted how their money should be the first to enter the market but, instead, it ends up waiting behind others. I’ve thought it at times too, but in the same breath, it has also happened the other way around too. It’s important to be honest.

It just wouldn’t make sense for Betfair to take such risks deliberately…

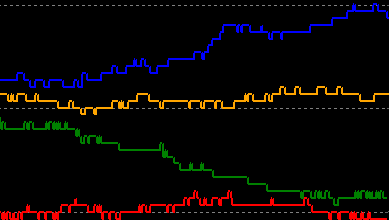

Take a look at the chart above, can you see how the different price actions force balanced movement between betting odds?

For you and me as traders, cross-matching is just another market influence to bear in mind. In some instances, being aware that cross-matching exists and is in operation presents an additional positive or negative to trading decisions. It provides an overall element of consistency to the markets.

Noticing market sentiment can be of particular interest to markets such as greyhounds, racing or even football (before the start). So having this characteristic active within the market provides some kind of structure to bear in mind. As shown earlier, one price goes up, another has to compensate.

Personal note: While it’s important to understand cross-matching and the impact it has. I think new traders get a little caught up on it sometimes, but don’t. Being unaware is daft, but obsessing about it will have you chasing your tail!

Cross Matching FAQs:

Hopefully, that’s a pretty thorough explanation as to how cross-matching works on Betfair. To finish up, here are a few questions I’ve noticed have cropped up over the years when talking to others:

Is cross-matching on for every market? Nobody knows for sure what the criteria Betfair uses to switch on or off. If they did, there’s a good chance it would be possible to exploit. It does seem to be on in most instances though. Automation users are probably the most likely to notice should it be off. To manual traders it’s of little importance, cross-matching will certainly be active when the betting is at its most fluid.

Is Betfair interfering in the market?

To this date, one of the biggest questions to arise from this topic has been the morality of Betfair intruding upon the markets like this. Although we can’t exactly give a final judgement against them, you can certainly say that they have altered the market and how it tends to behave. From here, the argument is up for debate and it often ends in what’s fair and what isn’t. Similar questions arise with various API upgrades and premium charges.

Is it fair?

It’s important to remember that Betfair is a licensed bookmaker and publically floated company, they are in control of their terms and conditions. Could we really expect them to just sit back and not squeeze it for all it’s worth?

Are there benefits for customers?

Betfair would argue it’s about getting customer’s bets matched, so that’s a positive. Although it takes away a lot of benefit from those scooping up value in the markets. Depends on who you’re talking about I guess. For the consistent winners, not so much.

How can I work out the staking differences for the algorithm?

Staking across the book has to be alternatively proportionate. Again I see no value in this as a manual trader, the geek’s toy software has a function called ‘trade shark hedge‘ which will do the maths for you within markets where there are only two selections. For example tennis. A quick example, similar to the one earlier in this article would mean in or create a similar match between 1.5 and 3.0. You would need to lay for double the stake you would have backed on the opposing player.

Does Betfair use bots?

According to the company itself, they are in control of an internal account which is seen as the ‘counter-party’ to the cross-matched bets.

Although there will be continued debate as to whether Betfair is right to step into the market in this way, the fact remains; cross-matching is there. There’s no value in complaining! You’re far better off understanding what’s going on and working around it.

Feel free to add any other questions about cross-matching and betting in the comments below and I’ll answer them directly.

The Advantages and Effects of Cross-Matching on Betfair…

Betfair’s cross-matching algorithm revolutionises the betting exchange by enhancing market liquidity and bet-matching efficiency. By automatically pairing inversely related bets across different outcomes, it boosts the chances of bets being matched, even in markets with low activity. This system ensures that traders experience fewer missed opportunities and more successful bets, contributing to a more seamless and reliable betting environment. For matched betting, it also makes it easier to get your bets on.

Cross-matching also promotes market fairness and balance. It prevents significant price gaps by matching bets across various outcomes, maintaining equilibrium within the market. This stability is essential for traders who depend on predictable conditions to implement their strategies effectively.

Additionally, cross-matching increases overall user engagement by making the betting process more efficient and satisfying. Traders are more likely to participate actively when they know their bets have a higher probability of being matched swiftly. This increased activity benefits the entire betting ecosystem by fostering a more dynamic and competitive environment.

In essence, Betfair’s cross-matching algorithm is crucial for improving liquidity, ensuring fair market conditions, and enhancing the overall user experience. Understanding these advantages can help traders optimise their strategies and achieve better results on the Betfair Exchange platform.

Related Articles: How Betting Odds Work | Understanding Weight of Money

16 thoughts on “How Does Cross Matching Work on Betfair? Full Explanation:”

Cross-matching will occur whenever it represents better value than matching on the single selection. What Betfair doesn’t say, they keep some of this value to themselves. I remember back in the day (2010?) when it was launched on Australian markets, they had to redistribute the profit from cross-matching back to the customers. Different jurisdiction I guess.

I guess unless they’re forced to divulge it, we won’t know how much they do or don’t make from cross matching.

What mean being na Exchange?! Player vs Player,or User vs User, no matter if in a tennis game, the market is offering both laying bellow 2.00 or backing both above 2.00. That is not Betfair problema. If Betfair Users have theyre Money in the market , thats theyre own responsability. Its a complete bullshit the excuse that is to giving liquidity to the markets. Betfair have bots operating in all markets with the goal of making Money, and they manipulate in same way that they always make green trades. This is perfectly easy to see in horse racing. Naive is who dont believe this, the same way that believe poker online is not rigged!

I think you may be a little confused between some of those that operate on Betfair and Betfair themselves… although its not beyond the realms of possibility.

I gave up using Betfair when they gubbed me from their sportsbook. I gave them a second chance when i realised they don’t have any real competition. The smaller exchanges are a waste of time. I gave up again when i backed a horse in the Grand National on the ante post market with the intention of laying it the day before the race and they suddenly without warning cancelled the market and wouldn’t allow me to lay against my ante post bet. This left me with a £500 bet at 139/1. They wanted me to deposit a ridiculous amount of money to cover it when i already had it covered. I complained and never received an apology. So i am finished with them.

Fair enough, sounds like you give up a bit there on a few things, Len. Why did you back on the sportsbook at that price? im sure it would have been bigger on the exchange.

Good article Caan and explained it well.

I used to study second by second movements in Horse Racing prices and it didn’t make sense that changes would happen at the exact same second. I wondered who this was and it was obviously Betfair! Their argument for more bets matched and more liquidity is essentially true – the same argument that the high frequency stock market traders used for what are doing in the stock market. In reality if it wasn’t Betfair, it would be a high frequency automated Betfair arbitrage trader would co-locate on a server right next to the Betfair server was. The fastest will win – so the average or even above average trader wouldn’t really get the benefit if cross matching wasn’t being used.

I did get a cross matching ‘dividend’ last October for the Australian markets but it was only 7 dollars so very low % and they didn’t give me any details

i suppose its no different from the big three bookies flooding the market on course to counteract their liabilties in the shops.

A little different, although similar concepts for them to hedge up i guess. Nowhere near as efficient though.

Hi and thanks for the clear explanation. Is betfair the only exchange to use this type of algorithm or are betdaq etc free of it? Seems to me to be an argument for using other exchanges if that is the case

I want to learn how to matching bets in local ids with betfair

Hi

I want to learn how to football, tennis or horse racing matching bets in local ids with betfair

There is something incorrect in this article. Let me explain.

The fact that cross matching was introduced does not mean that betfair match some bets. In fact, Betfair does not make a cent from this. Cross-matching means your bet can match bets on other selections -i.e. not only the selection you betted on. Let’s say it is Nadal vs Fed market. You want to back Nadal but there is no bet at the price you requested. Betfair will transform your back bet on Nadal into a Lay bet on Federer if the price is right.

Hi Arthur, it’s correct. There is a difference in the spread on many occasions when initiating the cross-match, which is where the profit comes from. For example 2.00 on Nadal and 1.98 is a 100% match in your example, however, a large sum coming in that triggers the XM between 2.00 and say 1.97 is not.

Cheers,

Caan

This is wrong betfair profit by matching both or multiple bets on their internal account at the prices asked for.

The easiest way to show it is this in the last strides of a horse race the backers will enter a bet at 1.01 while lay money may still be coming in at 1.05 or above, the 1.01’ers used to get matched at best odds, 1.05 and above until the only money on offer was at 1.01.

Now betfairs internal account lays the 1.01 at 1.01 while simultaneously backing the 1.05.

internal cross matching account matches £100 at 1.01 from the backers for £1 simultaneously arbing it at 1.05 or above as the late layers money hits the exchange..

both plays get matched at the odds they asked for,